Understanding Non-Sufficient Funds (NSF) Fees

Failed transactions and consequent fees can be frustrating, embarrassing, or unfair. This is especially true if you don’t have any idea what an NFS (Non-Sufficient Funds) fee is, or what triggered it in the first place.

So, what are NSF fees? NSF stands for non-sufficient funds and refers to attempting a payment without adequate money in an account to cover the charges. When this happens, many banks charge a returned item fee - commonly called an NSF fee or insufficient funds fee.

In this article, we will explore what triggers these fees, how much they typically cost, and how to avoid them. We will answer the question, “what is an insufficient funds fee?” Our goal is to provide the information you need to minimize the likelihood of paying unnecessary NSF fees.

The Causes and Costs of NSF Fees

Behaviors like writing a check or scheduling a bill payment without the needed funds in your account are the primary triggers for NSF fees. The bank cannot honor a payment if the money is not available and will charge you a fee for the rejected transaction.2

What is an Overdraft Fee and How Do They Differ from an NSF?

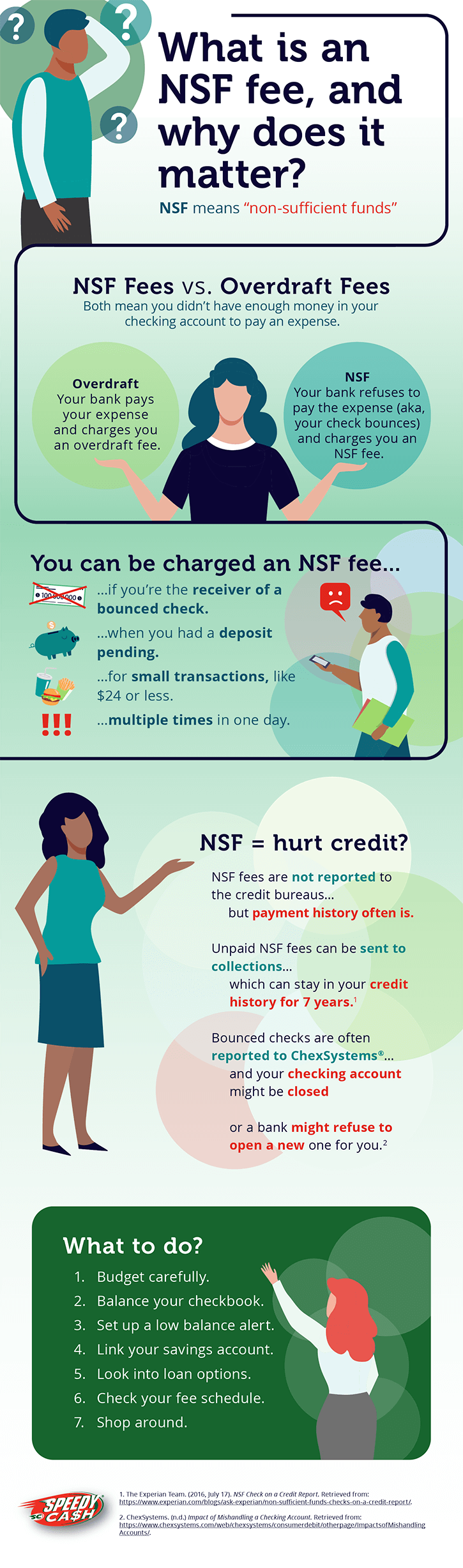

Overdraft fees work slightly differently than NSF fees. With an overdraft fee, the bank opts to pay the transaction despite a lack of funds and then charges for overdrawing the account. With NSF fees, the payment is returned unpaid. However, banks sometimes group overdrafts and NSF fees together under non-sufficient funds.

According to the Consumer Financial Protection Bureau (CFPB), the average NSF fee among major banks is around $34. But that single transaction is often just the beginning. Additional fees can come from:

- The payee, if their bank charges a returned item fee that gets passed back to you. This can amount to $5-35 per bounced check.

- Late fees, if a returned payment causes your bill to become past due.

- Per transaction fees, since banks tend to charge an NSF fee for each item - not per day. One spending miscalculation could result in multiple charges.

To illustrate, let’s walk through a hypothetical scenario. Say you have $100 in your checking account. You proceed to write checks for:

- $60 for your cell phone bill

- $55 for your electric bill

- $35 for a subscription service

In this case, not all three payments would successfully be paid due to insufficient funds, and your bank may charge you a $34 NSF bank fee for each item - costing you $102 in total fees.

Now imagine if your cell provider also levies a $25 returned check charge. Your fees for that single $60 cell phone bill could balloon to $59 ($34 bank + $25 cell provider). And that’s not even accounting for possible late fees due to the bounced payment.

As you can see, even a small miscalculation can become exponentially expensive when NSF fees enter the equation. To avoid paying hundreds in fees per year, understanding what causes them is critical. It’s important to check your bank’s fee schedule and your deposit account agreement to find out what you might be charged if you ever have insufficient funds.

Who Can Charge NSF Fees?

Your own bank is the most obvious source of NSF fees. But you may also incur insufficient fund charges from external parties:

- Recipient’s bank: If you write a paper check that bounces, the recipient’s financial institution can charge a return item fee. This often gets passed along to the check writer (you).

- Payee/merchant: As mentioned above, companies you write bad checks to will sometimes levy returned check fees or late payment fees.

- Collection agencies: Unpaid NSF fees can be sent to collections, harming your credit and potentially incurring further collection fees.

- ChexSystems: Banks report chronic account mismanagement to ChexSystems, affecting your ability to open future accounts.

In summary, one small overcharge can unleash NSF fees from your bank, recipient’s bank, merchant, collections, and impact ChexSystems - plus late fees and interest charges. Avoiding overdrawing accounts is key to preventing this cascade effect.1In summary, one small overcharge can unleash NSF fees from your bank, recipient’s bank, merchant, collections, and impact ChexSystems - plus late fees and interest charges. Avoiding overdrawing accounts is key to preventing this cascade effect.1

My NSF fees seem really high. How is that legal?

Currently, no laws exist to limit the amount a bank can charge for an NSF fee.4 With that said, your bank might have a policy that limits how many NSF fees they can charge you per day. That’s why it’s important to check your bank’s fee schedule and your deposit account agreement to find out what you might be charged if you ever have insufficient funds.

Do Pending Deposits and Transfers Help?

When an NSF situation arises, it’s tempting to think pending deposits or linked accounts will cover the difference in time. However, this is risky to rely upon.

Unfortunately, even if you have a deposit pending that will cover your expense, you could still get charged an NSF fee. Pending deposits are not yet available funds. Banks can hold deposits for days before you can withdraw against them, so they may not prevent an NSF fee. The same goes for mobile check deposits, which require an additional clearing period.

As for linked accounts, banks are not required to transfer funds to cover shortfalls. They may provide overdraft protection as a courtesy but usually charge a fee for this service. Assuming money will move over could be an expensive assumption.

Ultimately, pending transactions and linked accounts do not equate to guaranteed funds. The safest bet is having adequate available balances at the time each payment clears.

How NSF Fees Can Impact Your Credit

On their own, NSF fees are not directly reported to credit bureaus or reflected in your credit reports. However, the downstream effects of an NSF charge can negatively impact your credit in certain cases:

- Unpaid fees sent to collections could appear on credit reports and lower your scores.

- Paying bills late after a bounced check could show up on your credit history.

- Closing an account with mishaps on ChexSystems may reduce the average age of your credit history.

- Getting denied new accounts for repeated NSFs reduces your overall available credit.

So, while not a direct hit, NSF fees can contribute to lower credit through byproducts like collections accounts and damaged relationships with banks. Maintaining available balances is wise both for avoiding fees and protecting credit health.

Minimizing NSF Fees in Your Financial Life

Given the many direct and indirect costs discussed above, proactively avoiding NSF fees is in your best financial interest. Here are some tips to reduce encounters with non-sufficient funds:

- Budget carefully so you don’t accidentally spend more than you have.

- Balance your checkbook to keep track of all your deposits and withdrawals.

- Set up a low balance alert at your bank.

- Link your savings account to your checking account so money is automatically moved to cover any overdrafts.

- Look into an overdraft line of credit at your bank or online loan options to cover unexpected expenses between paychecks.

- Check your fee schedule and deposit account agreement so you’re aware of your bank’s policies.

- Shop for a bank that doesn’t charge overdraft fees on small amounts (like $5).

With vigilance around recording transactions, maintaining balances, and researching bank policies, NSF fees can often be avoided. But occasionally, mistakes happen despite one’s best efforts. By understanding the inner workings of these fees, you can be prepared and make informed choices if an NSF situation arises. A healthy, active budgeting plan is a great way to hopefully avoid NSF fees. Need help creating a budget? Check out our Personal Budgeting blog for tips.

Sources:

1Bennett, Karen. (2023, Sept 15). Overdraft fees vs. NSF fees: How they differ. Bankrate. Retrieved from https://www.bankrate.com/banking/checking/overdraft-fees-vs-nsf-fees/

2Avery, Dan & McMillin, David. (2023, Sept 28). What Are NSF Fees and Why Do Banks Charge Them? CNET. Retrieved from https://www.cnet.com/personal-finance/banking/advice/what-are-nsf-fees-and-why-do-banks-charge-them/

Infographic:

1The Experian Team. (2016, July 17). NSF Check on a Credit Report. Retrieved from: https://www.experian.com/blogs/ask-experian/non-sufficient-funds-checks-on-a-credit-report/.

2ChexSystems. (n.d.) Impact of Mishandling a Checking Account. Retrieved from: https://www.chexsystems.com/web/chexsystems/consumerdebit/otherpage/ImpactsofMishandlingAccounts/.